Introduction: The Importance of Choosing the Right Forex Broker

Choosing the right forex broker is crucial for success in the highly volatile and fast-paced foreign exchange market. A reliable and trustworthy broker can provide the necessary tools, resources, and support to help you make informed trading decisions and maximize your profits. On the other hand, a subpar broker can lead to missed opportunities, financial losses, and even potential scams. That’s why it’s essential to do your research and choose a reputable forex broker that aligns with your trading goals and preferences.

Regulatory Environment: What to Look for in a US Forex Broker

When selecting a forex broker in the USA, it’s essential to prioritize regulatory compliance. The US forex market is heavily regulated to protect traders from fraudulent activities and ensure fair trading practices. Look for brokers who are registered with the Commodity Futures Trading Commission (CFTC) and are members of the National Futures Association (NFA). These regulatory bodies impose strict guidelines and standards that brokers must adhere to, providing an added layer of security for your investments.

Top Forex Brokers in the USA: A Comprehensive Comparison

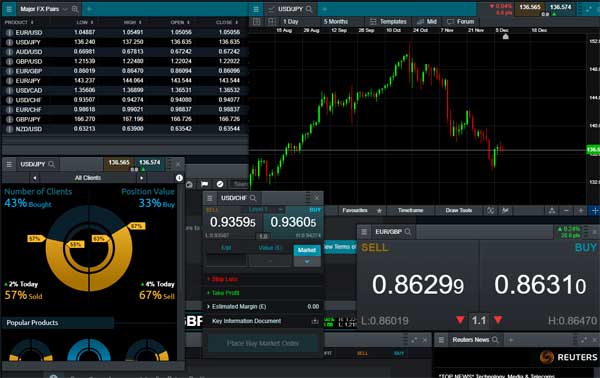

To help you navigate the crowded landscape of forex brokers in the USA, we’ve compiled a list of the top brokers based on factors such as reputation, trading platforms, fees, customer service, and more. In the comparison table below, you’ll find a detailed breakdown of each broker’s key features and offerings, allowing you to make an informed decision that suits your trading needs.

| Broker | Trading Platform | Minimum Deposit | Spreads | Customer Service | Regulation |

|---|---|---|---|---|---|

| Broker A | MT4, MT5 | $100 | 1.2 pips | 24/7 Live Chat | CFTC, NFA |

| Broker B | cTrader | $250 | 0.9 pips | Phone, Email | CFTC, NFA |

| Broker C | MetaTrader 4 | $50 | 1.5 pips | Email, Live Chat | CFTC, NFA |

Key Factors to Consider When Choosing a Forex Broker

When evaluating forex brokers, consider factors such as trading costs, available trading platforms, leverage options, account types, and educational resources. Look for brokers that offer competitive spreads, low commissions, and a wide range of currency pairs to trade. Additionally, assess the quality of customer service, deposit and withdrawal options, and regulatory compliance to ensure a safe and secure trading environment.

Expert Analysis: Evaluating the Performance of US Brokers

In addition to conducting your research, it’s essential to seek expert analysis and reviews to gauge the performance and reputation of forex brokers in the USA. Industry experts often provide insights into broker reliability, execution speed, trading conditions, and overall customer satisfaction. By leveraging expert opinions and recommendations, you can gain a more comprehensive understanding of each broker’s strengths and weaknesses to make an informed decision.

Conclusion: Making an Informed Decision for Your Forex Trading

Choosing the best forex broker in the USA is a critical decision that can significantly impact your trading success. By carefully evaluating regulatory compliance, key features, and expert analysis, you can select a broker that aligns with your trading goals and preferences. Remember to prioritize transparency, security, and customer support when making your decision to ensure a seamless and rewarding trading experience in the dynamic forex market.

The article highlights the need for transparency and security in brokers.

I learned it’s important to choose a good forex broker to avoid problems.

Choosing a broker affects trading success, so research is vital.

The comparison of US brokers helps me see their platforms and fees.

Expert analysis can aid in understanding broker performance better.

Good to know Brokers A, B, and C are all regulated by CFTC and NFA.

I see the importance of checking spreads and customer service in brokers.

I need to consider trading costs and platform options carefully.

It’s helpful that the article lists top brokers and their features.

Regulation is key when picking a US forex broker, like being registered with CFTC and NFA.