Exploring the Basics of Forex Leverage

Forex leverage is a powerful tool in the hands of a currency trader, allowing for the control of large positions with a relatively small amount of capital. At its core, leverage in the forex market involves borrowing a certain amount of money needed to invest in something. Forex brokers offer this leverage to enable traders to increase their trading position beyond what would be available from their cash balance alone. The concept is akin to putting a down payment on a house and financing the rest. However, in forex trading, this “loan” comes without interest charges.

The leverage ratio can vary significantly, from as low as 2:1 to as high as 500:1, depending on the broker and the size of the position being traded. This ratio essentially grants traders the ability to control a large amount of money using very little of their own and borrowing the rest from their broker. The primary appeal of leverage is that it amplifies the potential profits from trades. For instance, with a leverage of 100:1, a trader can control a position worth $100,000 with just $1,000 of their own capital.

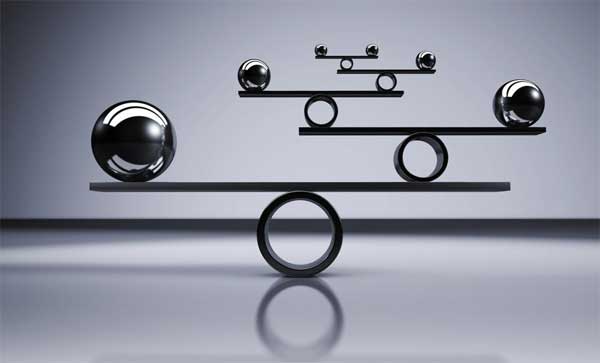

But it’s not all about amplifying profits; leverage is a double-edged sword. While it can magnify returns, it also increases the potential for losses, which can exceed the initial investment. Understanding the basics of forex leverage is crucial for traders to make informed decisions and manage their risk effectively.

The precise mechanism of leverage involves the broker providing the trader with the necessary funds to open a position. When a trader decides to close the position, the profit or loss is calculated based on the total size of the financed position, not just the trader’s initial investment. This system allows for significant profit potential but also poses a risk of substantial losses.

Forex leverage is expressed as a ratio, as mentioned earlier. The ratio tells the trader how much capital they control in the market relative to their deposit. For example, a 50:1 leverage ratio means that for every $1 in the trader’s account, they can control a trade worth $50.

Understanding the basics of forex leverage is foundational for anyone looking to trade currencies. It’s the key to unlocking potential profits but requires a clear comprehension of its risks and mechanics.

How Leverage Works in Forex Trading

Leverage in forex trading is a tool that increases the size of the maximum position that can be opened by a trader. Here’s how it works: a forex trader decides to buy or sell a currency pair. Instead of needing to pay the full price for the trade upfront, the trader uses leverage to borrow capital from their broker, allowing them to control a larger position than their own capital would otherwise permit.

This borrowed capital must eventually be settled with the broker, but in the meantime, it can be used to potentially amplify profits from the trading activities. The actual process involves the trader opening a margin account with the broker, through which leveraged trades are made. This margin account is used as collateral by the broker to lend the trader the necessary funds.

For example, if a trader wants to trade $100,000 worth of currency and uses a leverage ratio of 100:1, they only need to use $1,000 of their own capital. This leverage allows traders to make significant trades with limited personal capital, opening up opportunities for substantial profits.

However, the higher the leverage used, the greater the risk of loss. This is because the size of the losses is calculated based on the total size of the position, not just the amount of the trader’s own capital. Therefore, a small adverse move in currency rates can result in a disproportionately large loss, potentially exceeding the trader’s initial investment.

To manage the risks associated with leverage, traders must use risk management strategies, such as setting stop-loss orders, which automatically close a position at a predetermined loss threshold. Additionally, traders should closely monitor their positions and be prepared to act quickly to avoid significant losses.

In essence, leverage can be a powerful tool for forex traders, but it must be used with caution and a thorough understanding of the risks involved.

Calculating Leverage: Examples and Strategies

Calculating forex leverage is essential for understanding your potential exposure and risk in the market. To illustrate, let’s consider a few examples:

Example 1:

A trader with a $1,000 account balance uses 50:1 leverage to purchase a $50,000 position in a currency pair. This means the trader is effectively controlling a position 50 times larger than their original investment.

Example 2:

Another trader with a $5,000 account balance decides to use 100:1 leverage, enabling them to control a $500,000 position. This significantly amplifies both the potential profit and potential loss.

Strategically, traders might use different leverage ratios based on their risk tolerance and trading style. A conservative trader may prefer a lower leverage ratio to reduce risk, while a more aggressive trader might opt for higher leverage to maximize potential profits.

It’s also crucial to consider the margin requirement, which is the amount of capital needed to open and maintain a leveraged position. A higher leverage ratio means a lower margin requirement, but also higher risk. For instance, 100:1 leverage implies a 1% margin requirement, meaning the trader only needs to commit $1,000 of their own capital to control a $100,000 position.

Using leverage effectively requires balancing the desire for profit with the necessity of risk management. Implementing stop-loss orders and limiting the amount of capital invested in each trade are prudent strategies. Additionally, constantly monitoring the market and being aware of events that might cause volatility can help in managing the risks associated with high leverage.

In conclusion, calculating and understanding leverage is critical for developing effective forex trading strategies. By appreciating both the opportunities and pitfalls, traders can use leverage to their advantage while mitigating potential downsides.

The Risks and Rewards of Using Leverage

The use of leverage in forex trading brings with it significant risks and rewards, making it a double-edged sword that requires respect and understanding.

Rewards:

- Increased Profit Potential: Leverage allows traders to amplify their trading results. Small price movements in the forex market can lead to substantial profits when magnified by high leverage.

- Capital Efficiency: Traders can control a large position while using a relatively small amount of capital, freeing up funds for other investments or trades.

- Market Accessibility: With leverage, even those with a modest trading account can participate in the forex market, making it more accessible to the average investor.

Risks:

- Magnified Losses: Just as profits can be amplified, so too can losses. It’s possible for traders to lose more than their initial investment in a short period.

- Margin Calls: If the market moves against a leveraged position and the account balance falls below the margin requirement, brokers may issue a margin call, requiring additional funds to be deposited to maintain the position.

- Rapid Market Movements: The forex market can move quickly, and leveraged positions are especially sensitive to these movements. Unexpected events or news can cause significant losses almost instantaneously.

The key to managing these risks while enjoying the rewards of leverage lies in effective risk management. Strategies such as setting stop-loss orders, not over-leveraging positions, and continuously monitoring market conditions and margin levels can help mitigate the dangers of leveraged trading.

Moreover, traders should have a solid understanding of the market and leverage mechanics before entering positions. Education and experience can significantly reduce the risks and enhance the rewards of using leverage in forex trading.

Leveraging Wisely: Tips for Forex Traders

To leverage wisely in the forex market, traders should adhere to several guiding principles that can help navigate the risks and opportunities leverage presents.

- Start Small: Especially for beginners, starting with lower leverage ratios can help you gain experience without taking on excessive risk.

- Use Stop Losses: Always protect your trades with stop-loss orders. This can prevent large, unexpected losses and help manage risk effectively.

- Understand the Market: Knowledge is power. Understanding currency pairs, market dynamics, and how events may affect the market can help you make more informed decisions.

- Monitor Leverage Ratios: Keep an eye on your leverage ratio and adjust it based on your risk tolerance and market conditions. Not all trades require high leverage.

- Practice Risk Management: Never risk more than you can afford to lose on a single trade. Diversify your trades and use risk management strategies to protect your capital.

- Stay Informed: Keep abreast of market news and events. Economic announcements, political events, and market sentiment can all affect the forex market and should influence your trading decisions.

By following these tips, forex traders can utilize leverage to their advantage while minimizing the risks.

Regulatory Perspectives on Forex Leverage

Regulatory bodies around the world have taken a keen interest in forex leverage, recognizing both its benefits and its potential to amplify risks for traders. Regulations regarding leverage ratios vary significantly across jurisdictions, reflecting differing approaches to protecting retail traders and ensuring market stability.

In the United States, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) have set a maximum leverage ratio for major currency pairs at 50:1. This relatively conservative cap is designed to limit risk and protect traders from the potentially devastating effects of high leverage.

In contrast, some jurisdictions allow much higher leverage. For instance, brokers regulated by the Cyprus Securities and Exchange Commission (CySEC) can offer leverage up to 30:1 for major currency pairs to retail traders, and even higher for professional clients.

Regulators aim to strike a balance between market access and trader protection. High leverage offers significant profit potential but comes with equally significant risks. By imposing leverage limits, regulatory bodies hope to mitigate the chances of catastrophic losses due to overleveraged positions.

Recent years have seen a trend towards tighter regulation of forex leverage, as evidenced by the European Securities and Markets Authority (ESMA) imposing a cap of 30:1 for major currency pairs. These regulatory efforts underscore the importance of using leverage wisely and understanding its implications.

In conclusion, while leverage is a powerful tool in forex trading, it must be used with understanding and caution. Regulatory perspectives on leverage aim to safeguard traders against its risks, emphasizing the need for prudent leverage use and risk management strategies.

Comparison Table of Leverage Ratios by Region

Here’s a quick comparison of leverage ratios as regulated in different parts of the world:

| Region | Maximum Leverage for Major Currency Pairs |

|---|---|

| United States (US) | 50:1 |

| European Union (EU) | 30:1 |

| Australia (before 2021) | 500:1 |

| Japan | 25:1 |

| Cyprus (CySEC) | 30:1 for retail clients, higher for professional clients |

This table reflects the diverse regulatory landscape and highlights the importance of understanding the leverage rules applicable in each trader’s jurisdiction.

Forex leverage helps control large trades with little capital. Important to know risks!

Leverage can be high, up to 500:1. Powerful but risky tool.

Leverage can amplify profits and losses. Manage risk with strategies like stop-loss orders.

Using leverage can make big trades with small money. Careful with losses!

Leverage lets traders use borrowed money from brokers. Important to know the risks.

Understanding leverage in forex helps manage trading risks and profits.

Traders can borrow money from brokers to trade bigger. Profits and losses can be large.

The leverage ratio shows how much you can control in the market. Useful info!

Traders can use leverage to buy or sell more than they have. Watch out for big losses!