Unveiling the Mysteries of Forex Spreads

Forex spreads, often viewed as the backbone of foreign exchange trading functionalities, are the difference between the bid and the ask prices of currency pairs. This financial mechanism may seem straightforward at first glance, yet it embodies a complex web of factors that determine its fluctuation. For traders, understanding these spreads is paramount to executing profitable trades, as they directly affect transaction costs. Typically denominated in pips, these spreads serve as a primary revenue source for brokers, while also acting as a critical decision factor for traders when selecting their trading platforms. The intricacies of forex spreads are deeply intertwined with market dynamics, liquidity, and volatility, presenting both opportunities and challenges to traders. Unraveling the mysteries of forex spreads, thus, becomes an essential endeavor for anyone looking to thrive in the forex market.

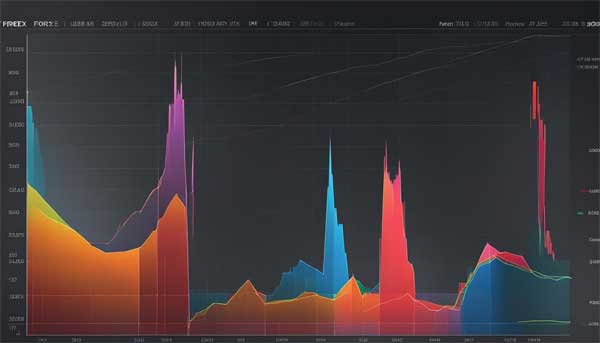

The Impact of Market Volatility on Spreads

Market volatility represents one of the most significant influences on forex spreads. During periods of high volatility, spreads tend to widen as the uncertainty in price movements increases the risk for liquidity providers. This phenomenon can be particularly observed during major economic announcements, geopolitical events, or financial crises. On the flip side, in times of low volatility, spreads can narrow, reflecting a more stable and predictable market environment. Traders must stay vigilant about these volatility-induced variations in spreads, as they can dramatically affect trading costs and strategies. By understanding that volatility and spreads are inextricably linked, traders can better anticipate fluctuations and make informed decisions.

Understanding Bid-Ask Spread Dynamics

The bid-ask spread in forex trading is the difference between the price a seller asks for and the price a buyer is willing to pay. The dynamics of this spread are influenced by several factors, including liquidity, demand, and market sentiment. A highly liquid market or currency pair often results in tighter spreads due to the higher volume of buyers and sellers. Conversely, less liquid pairs or trading times may see wider spreads. Additionally, a sudden change in market sentiment or demand can cause spreads to widen or narrow abruptly. For traders, grasping the nuances of bid-ask spread dynamics is crucial for timing their trades to minimize costs and maximize potential returns.

Key Factors Influencing Forex Spread Fluctuations

Forex spread fluctuations are shaped by a myriad of factors, among which liquidity and market volatility stand out. However, several other elements also play pivotal roles. Central bank policies, interest rate differentials, economic data releases, and geopolitical instability can significantly impact currency valuation and, consequently, spread dynamics. Time of day also affects spreads, with the opening and closing times of major forex markets often witnessing heightened volatility and wider spreads. Additionally, the choice of broker and their specific policies regarding spreads (fixed vs. variable) can greatly influence the trading experience. Traders must continually educate themselves on these factors to adeptly navigate the forex market’s ever-changing landscape.

Strategies to Navigate Wide Forex Spreads

Navigating wide forex spreads demands strategic foresight and adaptability from traders. One effective approach is focusing on trading during peak liquidity times, thereby capitalizing on narrower spreads. Additionally, employing stop-loss orders can help manage risks associated with wider spreads. Traders might also consider trading currency pairs with inherently lower spreads, though this may limit market exposure. Another strategy involves using limit orders to specify the maximum acceptable spread for entering or exiting trades, offering more control over transaction costs. Ultimately, a deep understanding of market conditions and spread dynamics can empower traders to devise strategies that mitigate the impact of wide spreads on their profitability.

The Future of Forex Spreads: Trends and Predictions

The future of forex spreads appears poised for significant evolution, influenced by technological advancements, regulatory changes, and market developments. Technological innovations, particularly in trading platforms and algorithmic trading, may lead to tighter spreads as market efficiency and liquidity improve. Regulatory shifts could also impact spread dynamics, either by increasing transparency and competition (thereby potentially reducing spreads) or imposing new costs on brokers that might get passed on to traders. Furthermore, the increasing participation of retail traders and the globalization of currency markets may contribute to more competitive spreads. However, geopolitical tensions and economic uncertainties could widen spreads due to increased volatility. Keeping an eye on these trends will be crucial for traders aiming to stay ahead in the dynamic forex market.

Comparison Table of Factors Influencing Forex Spreads

| Factor | Impact on Spreads | Example Scenario |

|---|---|---|

| Market Volatility | Increases risk; widens spreads | Geopolitical events, economic reports |

| Liquidity | Higher liquidity narrows spreads | Major trading hours |

| Economic Data Releases | Can cause sudden spread widening | GDP announcements, employment data |

| Central Bank Policies | Influences interest rates; affects spreads | Interest rate decisions |

| Time of Day | Opening/closing times may see wider spreads | Market open/close times |

| Broker Policies | Fixed vs. variable spreads | Broker-specific spread policies |

In conclusion, forex spreads are a crucial element of currency trading, influenced by a complex interplay of market dynamics. By understanding and strategizing around these factors, traders can better navigate the forex market’s fluctuating landscape, optimizing their trading outcomes in the process.

Future of spreads may change with technology. Watch for tighter spreads.

Important to trade during peak times. Spreads are narrower then.

Bid-ask spread is key. It’s the difference between seller and buyer price.

Understanding spreads helps in trading. It can optimize outcomes.

Liquidity affects spreads. High liquidity means tighter spreads.

Market volatility makes spreads wider. Be careful with economic news.

Central bank policies influence spreads too. They affect interest rates.

Forex spreads are important for trading. It’s about the difference in prices.